How to Stay on Top of Deadlines When Filing an Online Tax Return in Australia

How to Stay on Top of Deadlines When Filing an Online Tax Return in Australia

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Necessary Resources and Tips

Browsing the on-line tax return process in Australia calls for a clear understanding of your obligations and the resources available to simplify the experience. Crucial papers, such as your Tax Data Number and income statements, have to be carefully prepared. Choosing a proper online system can significantly affect the performance of your declaring process.

Understanding Tax Responsibilities

Individuals need to report their income accurately, which includes wages, rental income, and financial investment revenues, and pay tax obligations as necessary. Homeowners need to understand the distinction in between taxed and non-taxable income to guarantee compliance and optimize tax results.

For businesses, tax obligation commitments include multiple facets, consisting of the Item and Solutions Tax (GST), firm tax, and pay-roll tax. It is essential for businesses to sign up for an Australian Business Number (ABN) and, if applicable, GST enrollment. These obligations demand careful record-keeping and timely submissions of tax obligation returns.

Furthermore, taxpayers should know with readily available deductions and offsets that can reduce their tax obligation concern. Seeking suggestions from tax professionals can give useful insights right into optimizing tax obligation settings while making certain compliance with the regulation. In general, a comprehensive understanding of tax obligation responsibilities is vital for efficient economic planning and to avoid fines related to non-compliance in Australia.

Crucial Files to Prepare

Additionally, assemble any kind of pertinent financial institution statements that reflect rate of interest earnings, along with reward declarations if you hold shares. If you have other incomes, such as rental residential properties or freelance job, guarantee you have documents of these revenues and any kind of linked expenditures.

Consider any private wellness insurance coverage statements, as these can influence your tax obligation responsibilities. By gathering these crucial papers in advancement, you will certainly improve your online tax return procedure, lessen errors, and take full advantage of potential reimbursements.

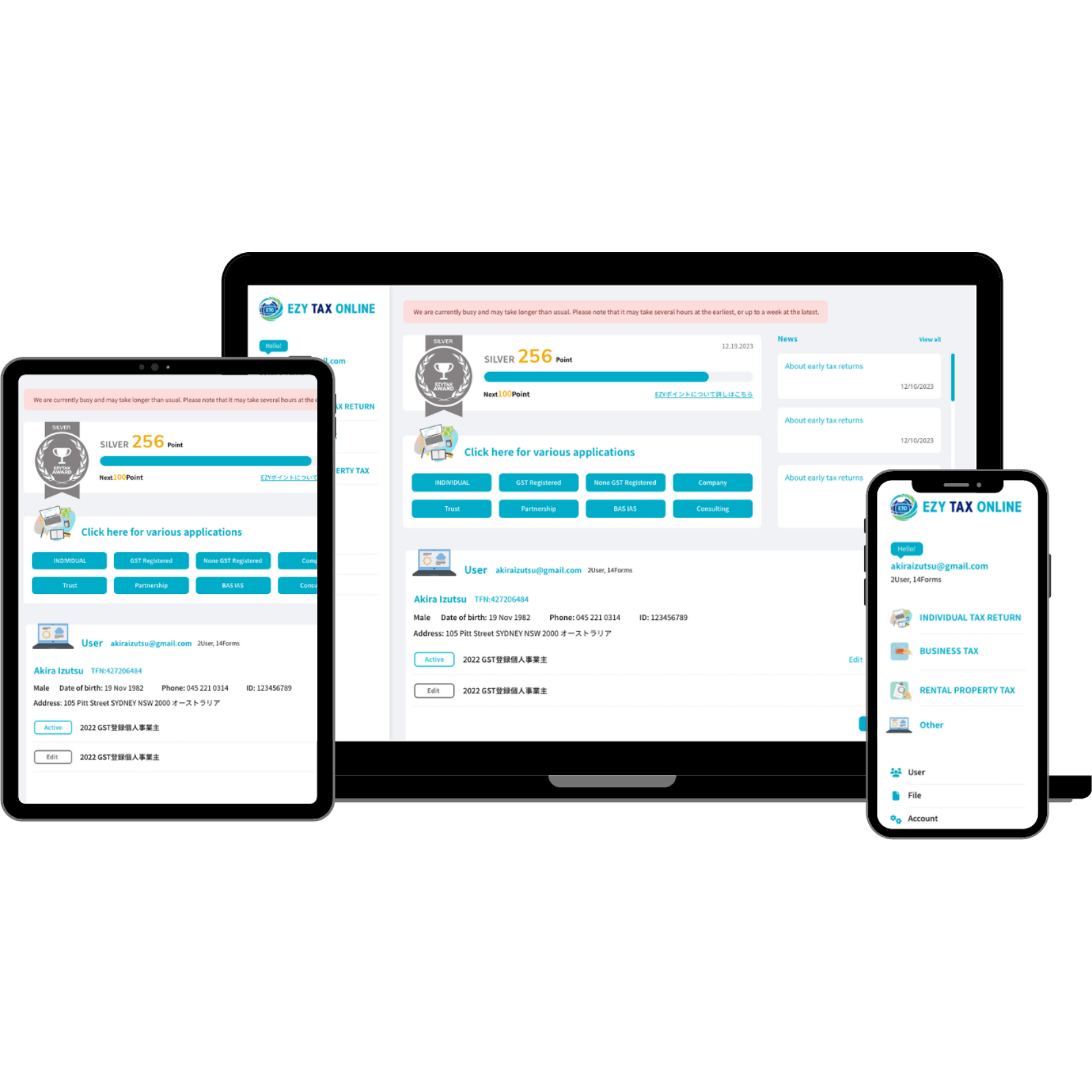

Picking the Right Online Platform

As you prepare to file your on-line tax return in Australia, selecting the right system is important to guarantee accuracy and ease of usage. An uncomplicated, instinctive layout can significantly boost your experience, making it much easier to navigate intricate tax obligation forms.

Next, analyze the platform's compatibility with your financial circumstance. Some services cater especially to people with simple income tax return, while others offer comprehensive support for extra complicated circumstances, such as self-employment or financial investment earnings. Moreover, search for platforms that provide real-time error monitoring and support, helping to reduce mistakes and making sure conformity with Australian tax laws.

An additional important aspect to take into consideration is Home Page the degree of client assistance offered. Reputable systems should supply access to assistance by means of e-mail, conversation, or phone, particularly throughout top filing periods. Additionally, study individual testimonials and ratings to assess the general contentment and reliability of the platform.

Tips for a Smooth Declaring Process

Submitting your on the internet income tax return can be a straightforward process if you follow a couple of essential ideas to guarantee efficiency and precision. Collect all necessary documents prior to starting. This includes your revenue statements, receipts for deductions, and any type of other appropriate documents. Having everything available reduces disruptions and mistakes.

Following, take benefit of the pre-filling attribute offered by several on-line platforms. This can conserve time and decrease the opportunity of errors by automatically populating your return with details from previous years and data given by your employer and banks.

Additionally, verify all entrances for accuracy. online tax return in Australia. Blunders can bring about postponed refunds or problems with the Australian Taxes Office (ATO) Make sure that your personal information, earnings figures, and reductions are right

Filing early not just decreases stress and anxiety yet additionally enables for better preparation if you owe tax obligations. By complying with these tips, you can browse the on the internet tax obligation return process efficiently and confidently.

Resources for Aid and Support

Navigating the intricacies of online tax obligation returns can in some cases be difficult, but a selection of sources for help and assistance are easily offered to assist taxpayers. The Australian Taxation Workplace (ATO) is the primary source of details, supplying extensive overviews on its web site, consisting of Frequently asked questions, training video clips, and live chat choices for real-time aid.

Additionally, the ATO's phone assistance line is available for those who favor direct communication. online tax return in Australia. Tax obligation specialists, such as licensed tax obligation representatives, can also provide individualized advice and make certain conformity with existing tax obligation regulations

Verdict

Finally, efficiently navigating the on the internet income tax return process click over here now in Australia requires a comprehensive understanding of tax obligation responsibilities, meticulous preparation of essential documents, and cautious choice of a proper online system. Abiding by sensible ideas can improve the declaring experience, while offered sources supply important assistance. By approaching the procedure with persistance and attention to information, taxpayers can make sure conformity and optimize prospective advantages, eventually adding to a more effective and effective income tax return outcome.

As you prepare to submit your online tax obligation return in Australia, choosing the right platform is crucial to make sure accuracy and ease of use.In final thought, successfully browsing the on-line tax return process in Australia requires an extensive understanding of tax obligation commitments, meticulous preparation of essential files, and cautious selection of a proper online system.

Report this page